Free insolvency advice for Limited Companies, Businesses and Individuals

We are licensed Insolvency Practitioners who specialise solely in giving insolvency advice and providing insolvency options to sole traders, individuals, partnerships and limited companies.

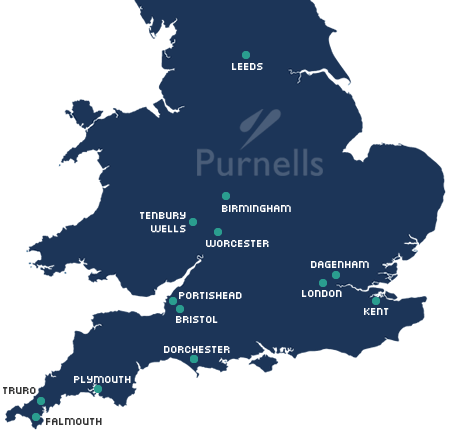

With two qualified licensed Insolvency Practitioners and from twelve offices we provide FREE personal insolvency advice & corporate insolvency advice throughout the UK.

Welcome to Purnells

As insolvency practitioners we also specialise in interpreting the legislation set out in The Insolvency Act 1986, The Insolvency (England and Wales) Rules 2016 and related case law to provide insolvency help and advice to our clients.

Our initial meetings are free and we always provide a letter of advice to our clients free of charge, so they can always rely on what we have said in writing.

Wherever you are in the UK one of our two qualified licensed insolvency practitioners can provide you with confidential business insolvency advice or individual insolvency advice over the telephone or in person. We will explain in clear and plain English all of the insolvency options open to you to enable you to make an informed decision as to which option you wish to follow.

There are many insolvency options available to help rescue you, your limited company or your underlying business.

Our experienced team aim to provide identifiable, measurable and financial benefits by providing clear insolvency advice to you regardless as to whether the issue is a corporate, limited company, partnership, sole trader or individual matter.

Who can we help?

Company Rescue

If your company is generally profitable however you have reached a crunch point with creditors, it may be possible to restructure the company or debt via either an Administration (which can freeze creditors whilst options are explored) or Company Voluntary Arrangement (a kind of debt repayment plan).

Company Closure

Closing a company is generally split between either a voluntary liquidation or a compulsory liquidation (as ordered by a court). Voluntary liquidations come in 2 forms, solvent (Members Voluntary Liquidation) and insolvent (Creditors Voluntary Liquidation).

Partnerships

If your partnership is insolvent, there are potentially multiple paths to either restructure or end the partnership, such as via a Partnership Voluntary Arrangement.

Bankruptcy

If you are personally insolvent, you may request the court to declare you bankrupt. Bankruptcy has long lasting implications and an IVA may be preferable. In some circumstances, you may be able to save your car, house and furniture.

IVA

An Individual Voluntary Arrangement is a formal agreement with your creditors for you to repay a portion of your debts over an agreed timescale. An IVA will often give your creditors the best return, and you some legal relief from them as well as the ability to maintain some assets (unlike bankruptcy).

Would you like us to give you a call?

Fill in the form and we'll give you a call as soon as we can to discuss your needs in a free initial consultation with a Licensed Insolvency Practitioner. Alternatively give us a call on 01326 340579 if there is an urgency to your needs.

The information provided will be used solely to contact you and any information you provide will be held in accordance with our firm's privacy policy, and not used for marketing purposes.